Product Brief:-

MARTONLINE is a checkout finance product with a mission to provide EMI option on offline purchase made on mom and pop stores and urban & semi urban areas of india. Our EMI option is named MARTONLINE. With MARTONLINE, we aim to solve for both retailers as well end consumer. Retailers get to list their shops on app hence increasing digital discovery, at the same time their end consumer can opt for EMI purchase using MARTONLINE feature on app, resulting in higher conversion and average order value for retailer and ease of purchase for end consumer. Eligibility for MARTONLINE is decided basis a sophisticated underwriting algorithm which utilises credit bureau data as well user’s device data and transactional and financial SMS data. User KYC and eligibility check is entirely digital and takes less than a minute to complete. Users who get the MARTONLINE limit can make a purchase by scanning the QR code at retail counter.

Indian consumer durable finance market is projected to grow from USD1110.63 million in FY20201 to USD2704.18 million in FY2027 (source-www.techsciresearch.com/report/india-consumerdurable-finance-market/7478). Most of industry is work around the white goods, a huge market space available in vanilla goods.

Problem: – In lot of categories customer prefer offline shopping but has to move online in order to avail EMI options (generally in vanilla goods), hence shopkeepers are unable to provide product on EMI resulting in user moving to online purchase. Lack of online discovery so no new customer acquisition.

Solution: – MARTONLINE

Features of MARTONLINE:-

- Due diligence of shopkeeper:- Physical credit profiling of shopkeeper and shop to be done before onboarding of shop, accordingly disbursal limit is decided on shop level.

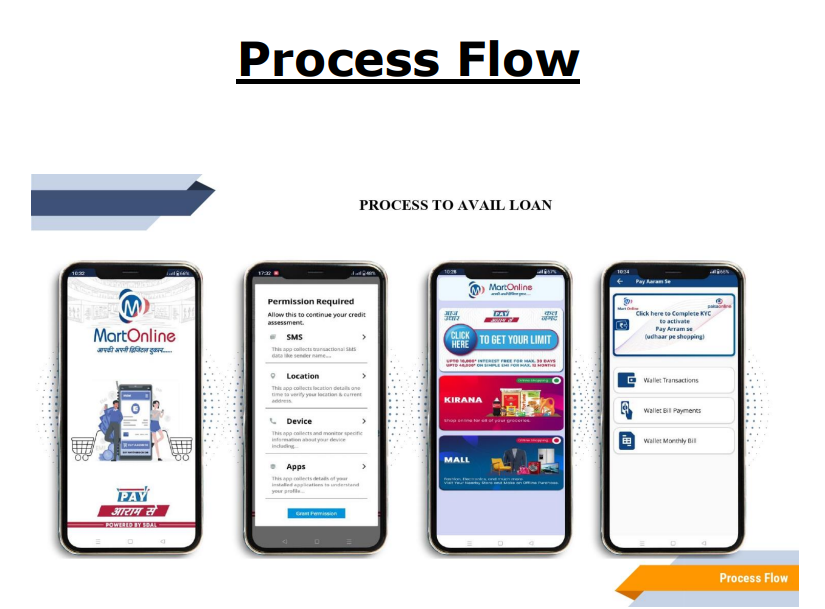

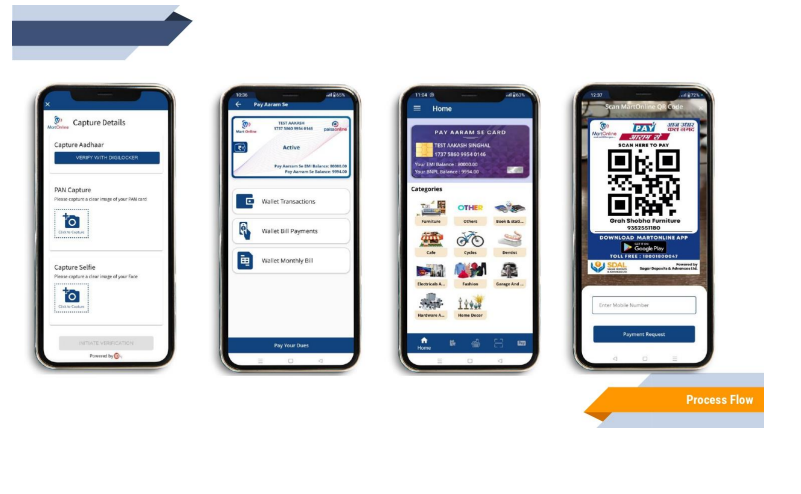

- Complete digital and paperless process: – Singh up through single OTP, Aadhar verification through Digilocker, Pan Card verification through NSDL, Live selfie match with pan and aadhar photo.

- Credit Criteria: – Bureau and Device data analysing in background to enrich the creditworthiness calculation, Approx. 176 data checks points are there to decide creditworthiness of customer.

- End use Confirmation: – Copy of sale bill, shopkeeper selfie with customer handover the product is mandatory before disbursement.

- Collection: – E-Nach is mandatory to utilise the limit.

- Risk control: – Diversification of risk by disbursing small ticket size loan to many customers.